Insights and Commentaries

COP21 side event – Financing the Demonstration and Deployment of CCS in Developing Countries

15th December 2015

Topic(s): Carbon capture, Economics, law and regulation, Policy, Public engagement, use and storage (CCUS)

The landmark Paris conference on climate change in December 2015 provided an opportunity to discuss all aspects of decarbonisation. The Global CCS Institute attended the conference and advocated for carbon capture and storage (CCS) as an important component of decarbonisation efforts. On Tuesday 8 December the Institute hosted a high profile side event featuring speakers from the Grantham Institute, International Energy Agency and World Bank to discuss the key issues facing CCS. In this Insight the Institute's Senior Advisor, Capacity Building & Public Engagement for The Americas, Meade Goodwin, provides a summary of the event.

On Tuesday 8 December, in front of a room full of attendees located within the official ‘blue zone’ of the UN Climate Talks in Paris, the Institute’s CEO Brad Page moderated an event on financing the demonstration and deployment of CCS in developing countries.

Meeting the 2°C goal requires the long-term global decarbonisation of the energy and industrial sectors in a cost-effective manner, and this means significant deployment of CCS is needed in both developed and developing countries over the coming decades. The Institute’s side-event discussed ways and means of financing CCS in the energy and industrial sectors, with a focus on developing countries.

The distinguished panel included speakers (from right to left):

- Philippe Benoit – Head of Energy Efficiency and Environment Division, International Energy Agency (IEA)

- Anita George – Senior Director Global Practice on Energy and Extractive Industries, World Bank

- Lord Nick Stern – IG Patel Chair of Economics and Government, Grantham Institute (LSE)

- Rodolfo Lacy Tamayo – Mexico’s Undersecretary of Planning and Environmental Policy

- Takeshi Nagasawa – Director, Global Environment Partnership Office, METI

- Abyd Karmali – Managing Director, Climate Finance at Bank of America Merrill Lynch; and GCF private sector representative

- Ashok Bhargava – Chair of the Energy Sector Committee and Director, Energy Division - East Asia Department, Asian Development Bank (ADB)

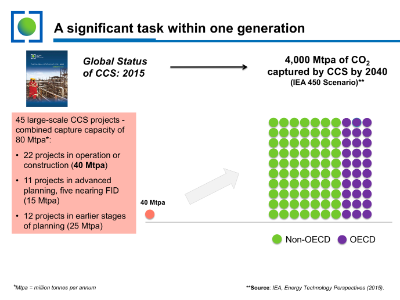

Mr Page provided an overview on the necessary role for developing countries when it comes to CCS development and deployment, stating that to be on track with the 2°C trajectory, CCS will need to be scaled up some 100 times from its current capture capacity.

Lord Stern explained that the most cost effective way you can hold global average temperature rises to 2°C must include CCS. He reflected that while the world is currently capturing some 28 million tonnes (Mt) CO2 per annum from 15 operational projects, much more still needs to be done. He said that "20 projects is not enough. We need 100 or 150 projects. We need to push very hard to get more projects" and in order to get more projects, especially in developing countries, governments must implement strong policies and/or commit to much more public investment in CCS.

Lord Stern closed by identifying the so-called "elephant in the room"; the fact that over 2,700 new coal fired power plants will be built over the next few decades - in addition to about 1,000 existing coal fired plants the IEA believes will still be operational in 2040. In the context of the greenhouse gas stock issue and ever dwindling and finite carbon budget available, Lord Stern said that the world needs a way to keep the associated emissions embedded in the global coal fleet out of the atmosphere. Further, he added that for some industrial processes like steel, aluminium and iron there is no alternative other than CCS.

Philippe Benoit identified 3 core points on CCS:

- The IEA’s climate analysis indicates that CCS needs to contribute about 13% or 100 billion tonnes (Gt) CO2 of the global cumulative emission reductions required by 2050 to maintain a least-cost track to meeting the 2°C goal.

- While there's a lot of discussion on supporting CCS pilot projects, Philippe thinks the discussion should focus on supporting a full scale demonstration project in a developing country by securing "real money". He said that the IEA’s analysis indicates that a commercial scale CCS project might require about US$400 million (perhaps grant funding) from, for example, multi-lateral development banks - who are used to this scale of investment; and US$600 million in loans.

- Philippe re-enforced the point that this is not an "either/or" for CCS, renewables or energy efficiency; but rather, we need to have all of these technologies if we are to keep below 2°C of warming.

Philippe reiterated that the IEA considers critical the support of CCS projects in developing countries and reaffirmed commitment to working with other international partners such as the Institute to explore appropriate financing models.

Anita George gave an overview of the World Bank's commitment to CCS in developing countries and reflected on how resources might be mobilised to support such projects. She emphasised the work the bank is doing in South Africa, Mexico, Indonesia and China. The World Bank has a dedicated CCS Trust Fund, which provides a forum for all of these counties to compete for capacity development work, studies and pilot projects.

One of her key points was that localised capacity development is critical to develop and deploy CCS. This is why the World Bank is focused on building the capacity upfront - so that pilot CCS projects can be up-scaled to commercial scale.

Ashok Bhargava stated that the ADB is committed to CCS and has a dedicated Trust Fund much like the World Bank (co-funded by the Institute). He observed that developing countries seem to have a primary focus on developing renewables and energy efficiency. But like Lord Stern, he identified the core issue as the demand for coal fired power and industrial products such as iron and steel. He also indicated the ADB's focus is predominately CCUS in China, and last week they launched a CCS China roadmap here at COP21.

Abyd Karmali provided some private sector views on financing CCS investments in developing countries. He said that the Bank of America-Merril Lynch alone managed some US$90 trillion dollars; and so financing CCS it is not a liquidity issue but it is a rate of return issue (noting that it's still in a demonstration phase and not a commercial deployment phase yet).

He also indicated that there needs to be adequate risk sharing in any finance package, scale and aggregation, and liquidity. Financiers tend to hold concerns over a lack of cost-reduction curves for specific CCS technologies and/or learning curves which are available for most renewables. He also suggested that additional concerns exist around emerging markets.

Finally, Rodolfo Lacy discussed Mexico's 15 year history in CCUS. Mr Lacy described the process that his Government has gone through in regard to current energy reform efforts as well as the North American and Mexican Carbon Storage Atlas that was first released in 2014. Mexico has two pilot projects planned that should be up and running by 2017.

Mexico has been focused on three main issues over the past two years as the Government has been working with the Global CCS Institute and the World Bank on capacity development:

- Gas on CCUS: As Mexico does not use much coal the main issue is the application of CCUS to natural gas plants

- Regulations on the life-cycle analysis

- Review of the legal and financial regulations to ensure that CCUS has fair treatment.

Takeshi Nagasawa spoke on Japan’s Joint Crediting Mechanism (JCM) which he describes as a bottom-up approach to implementing a market mechanism. He confirmed that METI was interested in including CCS in the portfolio of JCM projects. They have been conducting scoping studies and are hoping that the first JCM project on CCS will be in Mexico and then the next one in Indonesia.